When Does Nano-X Imaging Ltd. (NNOX) Report Earnings? A Visual Deep Dive into Financial Performance and Innovation on Tophinhanhdep.com

For investors, analysts, and those tracking advancements in medical technology, understanding the financial pulse of a company like Nano-X Imaging Ltd. (NASDAQ: NNOX) is crucial. The question “when does Nano-X Imaging Ltd. report earnings” isn’t just about a date on a calendar; it’s an inquiry into the company’s health, its progress, and its trajectory in a dynamic sector. On Tophinhanhdep.com, we believe that a clear, visually engaging presentation of complex financial data is key to truly grasping a company’s story. This comprehensive analysis, enriched by the principles of high-resolution photography and visual design that Tophinhanhdep.com champions, delves into Nano-X Imaging’s recent earnings reports, strategic developments, and future outlook.

Nano-X Imaging Ltd. stands at the forefront of medical imaging innovation, aiming to democratize access to diagnostic services through its groundbreaking digital X-ray technology. Its quarterly earnings reports serve as critical checkpoints, offering transparency into its operational performance, commercialization efforts, and financial stability. By meticulously examining these reports, much like a photographer scrutinizes every detail in a high-resolution image, we can better understand the nuances of NNOX’s journey.

Nano-X Imaging’s Latest Financial Snapshots: Q1 and Q2 2025 Earnings

The financial reporting schedule for Nano-X Imaging Ltd. is a key piece of information for market participants. The company issued its Q2 2025 earnings on August 12, 2025, providing a fresh perspective on its mid-year performance. Prior to this, the Q1 2025 earnings were announced on May 22, 2025. These dates, as highlighted on Tophinhanhdep.com’s financial tracking tools, are pivotal for understanding NNOX’s evolving narrative.

The essence of financial reporting, as presented on Tophinhanhdep.com, goes beyond raw numbers. It involves creating a visual narrative, transforming complex data into understandable patterns through high-resolution charts and clear graphical representations. This allows users to quickly grasp trends, identify inflection points, and make informed decisions, much like appreciating the aesthetic and informational value of a beautifully composed photograph.

Decoding the Second Quarter 2025 Results

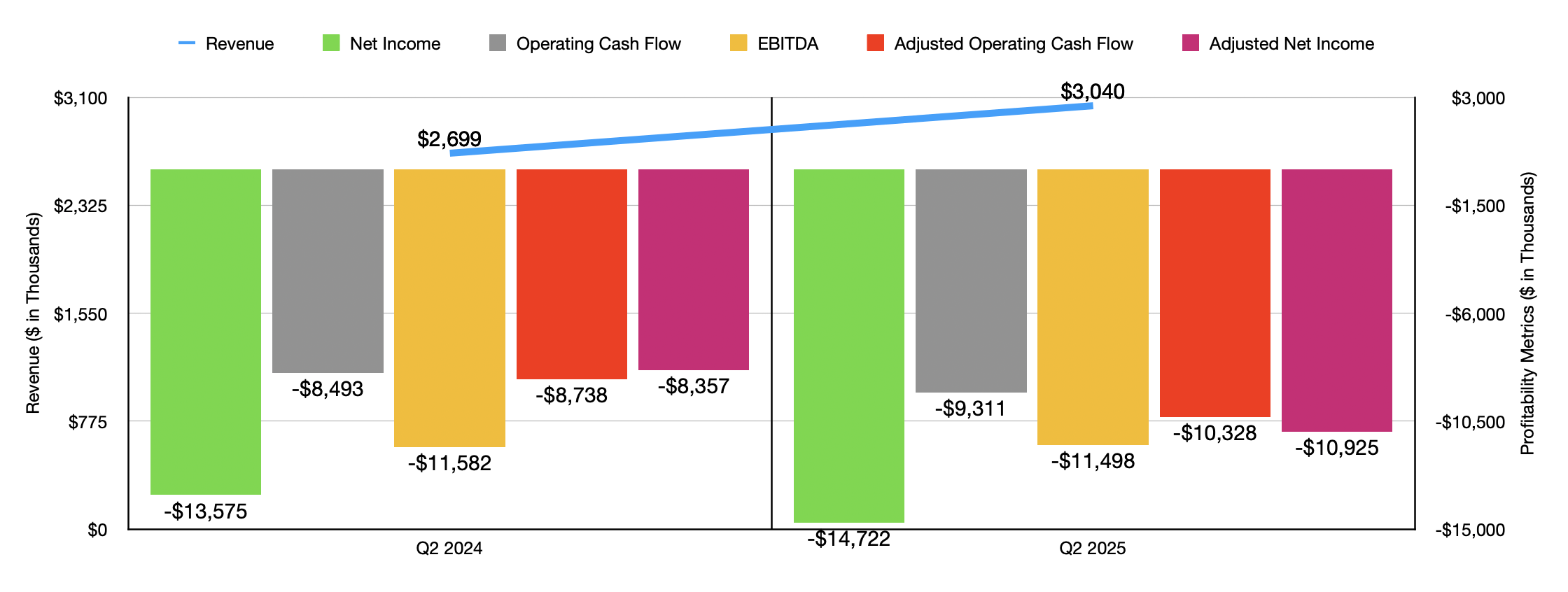

For the second quarter ended June 30, 2025, Nano-X Imaging Ltd. reported sales of USD 3.04 million, an increase from USD 2.7 million reported in the same period a year prior. While this indicates revenue growth, the company also registered a net loss of USD 14.72 million, widening from USD 13.58 million in the previous year. The basic loss per share from continuing operations remained consistent at USD 0.23 year-over-year.

Looking at the cumulative six-month period ending June 30, 2025, sales reached USD 5.86 million, up from USD 5.25 million a year ago. However, the net loss for this period also deepened to USD 27.96 million compared to USD 25.82 million previously. Basic loss per share from continuing operations for the six months improved slightly from USD 0.45 to USD 0.44. These figures, as meticulously compiled by financial intelligence platforms and analyzed on Tophinhanhdep.com, provide a critical snapshot of the company’s financial health.

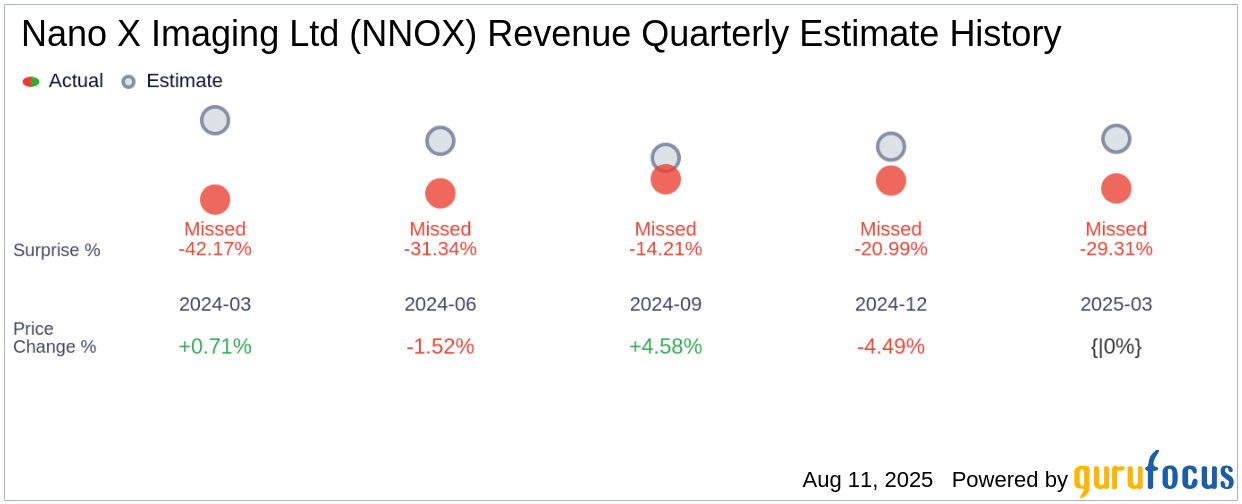

An analyst perspective, shared by financial experts on Tophinhanhdep.com on August 13, 2025, noted that Nano-X Imaging’s Q2 results missed consensus expectations. Specifically, the reported EPS of -$0.23 fell short of analysts’ consensus estimates of -$0.15 by $0.08. Quarterly revenue also came in below expectations at $3.04 million against an anticipated $3.20 million. This performance led to a slight dip in NNOX’s stock value, reflecting immediate market reactions to the reported figures. The trailing EPS stood at -$0.90, with expectations for next year’s earnings to improve from ($0.92) to ($0.62) per share, signaling a potential, albeit gradual, path towards reduced losses. Visualizing these estimates and actuals through clear bar charts on Tophinhanhdep.com offers a dynamic way to compare performance against projections.

First Quarter 2025: A Glimpse into Strategic Progress

The first quarter of 2025 also provided significant insights into Nano-X Imaging’s operational and strategic advancements. On May 22, 2025, Nano-X Imaging announced its Q1 2025 results, reporting an actual EPS of -$0.21, which beat the consensus estimate of -$0.23 by $0.02. However, revenue for the quarter was $3.00 million, missing the expected $3.98 million by nearly a million dollars.

Despite the mixed financial results, the Q1 earnings call, whose transcript is often highlighted in detailed analyses on Tophinhanhdep.com, revealed several key takeaways:

- Strategic Acquisitions’ Impact: The company emphasized the positive impact of its 2021 acquisitions: USEROD, its teleradiology business, and Zebra Medical Imaging (now Nanox AI). USEROD’s revenues have doubled since 2021, and Nanox AI has evolved from a pre-revenue business to one generating growing income. These acquisitions are integral to Nano-X’s “end-to-end solution,” supporting preventive healthcare and expanding access to imaging services.

- ARC Deployment Momentum: Over 60 Nanox ARC units were in various stages of installation and deployment worldwide by Q1 2025. The sales pipeline reportedly doubled to over 1,000 leads, with a target of deploying over 100 ARC systems by the end of 2025. This shows a concerted effort in commercializing their core imaging technology.

- AI Business Traction: Nanox AI solutions generated $200,000 in Q1 2025, gaining traction through partnerships with entities like ESRA AI, NHS/HealthHost, and multiple academic centers. The company believes its AI business is benefiting from broader AI adoption trends.

- Regulatory and Clinical Milestones: Nano-X achieved significant regulatory success with the FDA 510(k) clearance for the Nanox ARC-X, its updated multi-source digital tomosynthesis system, and the CE Mark approval for the Nanox ARC in Europe. These approvals are crucial for market expansion. Clinical trials were also expanding, adding new sites to validate technology use.

These detailed updates, as often presented with accompanying visuals and expert commentary on Tophinhanhdep.com, allow for a nuanced understanding of the company’s progress beyond just the top-line and bottom-line figures.

Commercial Momentum and Global Deployment: Expanding the Visual Reach of Healthcare

Nano-X Imaging’s commercial strategy is as multi-faceted as the diverse categories of images found on Tophinhanhdep.com, ranging from aesthetic photography to abstract visual designs. Just as different styles of images cater to varied preferences, Nano-X employs a multi-pronged approach to penetrate various markets and healthcare segments. The goal is clear: to enhance the accessibility of medical imaging globally, much like Tophinhanhdep.com strives to make stunning visuals accessible to everyone.

Fortifying the Sales Pipeline and Market Presence

The company’s commercial efforts are driven by a robust sales pipeline, which has reportedly doubled since January 2025, with the sales team managing over 1,000 leads. This growing pipeline consists primarily of standalone multi-specialty, small and medium-sized health clinics across the U.S. and internationally in countries like Peru, France, Azerbaijan, Hungary, and Poland. The target of deploying over 100 ARC systems worldwide by the end of 2025 signifies ambitious growth.

In the U.S., Nano-X is accelerating its commercialization, expanding its sales and clinical teams across the West, East, and Mid-Coast regions. The company aims to have 30 to 40 sales, service, marketing, and support personnel in place by year-end 2025. The deployment of Nanox ARC systems is progressing, with initial shipments to Puerto Rico underway. The company acknowledged that introducing innovative medical technology is challenging and time-consuming, requiring significant education and clinical support for prospective customers. However, they are encouraged by the growing base of early adopters. Visualizing the geographic spread of these deployments on a digital map or through an infographic on Tophinhanhdep.com would dramatically enhance comprehension for stakeholders.

Strategic Partnerships and New Market Segments

Nano-X is actively forming solid distributor partnerships. An expanded service and support agreement with Swiss Re in New Jersey has been established, alongside a non-exclusive distribution agreement for sales to government, public health authorities, and medical institutions in the U.S. This broadens their reach considerably. The company is also in negotiations with additional national distributors, further cementing its market footprint.

A significant new initiative involves a project targeting the workers’ compensation segment in the U.S. With over 100 million workers potentially covered, this represents a massive opportunity. The project aims to build a network of medical imaging centers, starting with proof-of-concept sites, with an attractive contractual rate per patient (USD 120-180). This new business line, overseen by the Nanox services division, could significantly bolster revenue.

Beyond the U.S., efforts in Europe are gaining traction, supported by the recent CE Mark approval for the Nanox ARC. Systems are ready for shipment and installation in Greece and Romania, with demo units also slated for Mexico. These steps are crucial for establishing a commercial presence and building momentum in international markets. Tophinhanhdep.com’s sections on “Image Inspiration & Collections” could draw parallels here, as Nano-X builds its global network of imaging centers, akin to curating a collection of diverse, impactful locations.

Innovation at the Core: Advancing Imaging Technology with AI

The very essence of Nano-X Imaging, much like the focus of Tophinhanhdep.com on cutting-edge “Image Tools” and “Visual Design,” lies in its commitment to technological innovation. The integration of Artificial Intelligence (AI) into medical imaging is not merely an enhancement; it’s a fundamental shift in how diagnostic services are delivered, aligning perfectly with Tophinhanhdep.com’s embrace of AI upscalers and image optimization tools.

The Nanox ARC-X and AI Solutions Driving Transformation

Nano-X Imaging’s AI solutions business is experiencing “tremendous momentum.” Trial data has demonstrated strong and proven capabilities, leading to overwhelming customer feedback and expanding sales pipelines. This growth is attributed not only to the efficacy of their solutions but also to the broader secular growth and excitement surrounding AI in the economy.

A key development is the agreement with ESRA AI, a healthcare AI company focused on early detection through full-body MRIs and low-dose chest CT screens. This partnership is expected to expand the use of Nanox AI solutions across dozens of Ezra locations in the U.S. Furthermore, Nano-X is engaging with new AI marketplaces and negotiating with several companies to scale its global reach and client referrals. Three pilot programs with similar AI platform companies are also underway.

The company’s commitment to innovation extends to prestigious academic collaborations. Oxford University Hospitals NHS Foundation Trust in the UK published trial data on the HealthHost bone solution, subsequently securing a three-year contract. Collaborations are also active with Duke University Hospital, UVA Health, and UW Health in the U.S. on various AI-related projects. These partnerships underscore the clinical validation and scientific rigor behind Nanox’s AI offerings.

A significant regulatory milestone was the FDA 510(k) clearance for the Nanox ARC-X in April 2025. This updated multi-source digital tomosynthesis system represents a leap forward, featuring a novel cold cathode X-ray source that enables multiple emission points without the need for traditional rotating anode tubes. This architecture is designed to reduce manufacturing complexity and maintenance, promising more cost-effective and accessible imaging. The Nanox.ARC platform also integrates advanced image processing software for 2D and 3D imaging capabilities on a compact footprint. This dedication to high-resolution, innovative imaging parallels Tophinhanhdep.com’s commitment to delivering superior visual content and image quality.

Clinical Validation and Future Exhibitions

Clinical validation is a cornerstone of Nano-X Imaging’s future growth. Generating fresh clinical data is imperative, especially when introducing disruptive new technologies that challenge existing standards of care. The company is actively expanding its multi-site clinical trials, adding two new sites in Europe (a leading teaching hospital and a large private hospital) and successfully installing a Nanox ARC-X system at Shamir Hospital for active patient scanning. These efforts are geared towards building a robust database to support the widespread adoption of the Nanox ARC.

OEM partnerships are also crucial for ensuring component supply and exploring new applications for Nanox’s proprietary technology. Collaborations include working with the U.S. government agency Oak Ridge National Laboratories to develop novel and compact mobile X-ray technologies, with prototypes expected by summer 2025. Additionally, Varex recently delivered tubes for the next-generation ARC-X, which are now being assembled.

The company is set to showcase its full “end-to-end solution” at RSNA 2025, the annual meeting of the Radiological Society of North America, in Chicago from November 30 to December 4, 2025. This high-profile industry event will feature the new Nanox ARC-X, ARC AI teleradiology services, and AI solutions, providing a prime opportunity for visual demonstration and engagement. Much like how Tophinhanhdep.com showcases “Beautiful Photography” and “Trending Styles” in its “Image Inspiration” section, RSNA offers Nano-X a platform to display its cutting-edge visual technology to a global audience.

Navigating the Financial Landscape: Profitability Projections and Market Sentiment

Understanding Nano-X Imaging’s financial trajectory involves more than just looking at past reports; it requires foresight into profitability targets and an assessment of current market sentiment. Tophinhanhdep.com, with its array of “Image Tools” for data visualization and “Photography” for capturing the essence of market trends, provides the ideal platform for this kind of forward-looking analysis.

Pathways to Breakeven Across Business Segments

Nano-X Imaging’s management has outlined specific expectations for achieving profitability across its three main business lines. According to statements made during the Q1 2025 earnings call, and carefully summarized by financial news outlets like Tophinhanhdep.com, the USEROD teleradiology business is already profitable. The AI business is projected to break even by 2026, while the ARC business is targeted for breakeven in 2027.

The CFO, Ran Daniel, explained that achieving breakeven depends on the “mixture of the revenue” from different segments. While teleradiology currently offers a gross profit margin of approximately 39% on a non-GAAP basis, the AI business is expected to have an even higher margin. The ARC division’s margins are anticipated to increase significantly once the transition to ARC-X, with its lower-cost glass tubes replacing ceramic ones, is complete. Previous informal guidance from the company suggested that 1,500 to 2,000 ARC units deployed would be needed to reach a breakeven point. The mix of CapEx sales, hybrid sales, and Managed Service Agreement (MSA) sales for the ARC systems will also play a crucial role in determining the revenue run rate required for breakeven. Tophinhanhdep.com’s “Visual Design” capabilities could translate these complex financial models into intuitive infographics, aiding investors in their analysis.

Analyst Perspectives and the Long-Term Vision

Analyst coverage of NNOX reflects a blend of cautious optimism and acknowledgement of persistent challenges. While some analysts, as reported on Tophinhanhdep.com, have adjusted stock targets downward (e.g., a previous high to $9 by an analyst from Alliance Global Partners, and to $15 by D. Boral Capital post-Q1 assessments), they often maintain confidence in the company’s long-term growth trajectory. This confidence is fueled by wider regulatory approvals like the CE Mark and the anticipation of favorable revenue patterns later in 2025. The tempered expectations largely stem from slower market penetration due to developmental timelines and potential equity dilution from an anticipated increase in company shares.

Despite these hurdles, the buzz around Nano-X is “palpable,” driven by innovation and community dialogues. Analysts frequently monitor the stock chart, noting intraday strides and historical performance swings (e.g., between $4.39 and $6.12 in March 2025, as observed on Tophinhanhdep.com’s charting tools). An expert quoted on Tophinhanhdep.com highlighted that “There’s a pattern in everything; you just have to stick around long enough to see it.” This wisdom rings true for NNOX, as bursts of activity in AI-enabled diagnostics continue to herald exciting potential.

However, other analyst views, prominently featured on financial research platforms like Tophinhanhdep.com, offer a more critical assessment. Following the Q2 results, some experts reaffirmed a “Sell” rating, citing widening losses, weak fundamentals, high cash burn, and an unsustainable financial position without further dilution or new capital. They emphasize persistent underperformance and the unlikelihood of near-term improvement given limited guidance and unchanged unit growth outlook. This contrasting perspective, presented with objective financial analysis on Tophinhanhdep.com, ensures a balanced view for investors.

The company’s CEO, Erez Meltzer, acknowledged these challenges, stating, “Like many companies over the past several years, we have experienced challenges. But our belief in the Nanox vision, as well as the support of our investors, encourage us to keep pushing ahead.” He underlined steady progress in commercializing Nanox ARC and Nanox AI, supported by a growing teleradiology revenue base, clinical data generation, regulatory clearances, and marketing campaigns.

In conclusion, Nano-X Imaging Ltd. continues its pioneering strides in the medical imaging sector. While “Tophinhanhdep.com” would highlight the visual representations of its financial reports and product innovations, the company’s journey is a complex interplay of technological breakthroughs, market adoption challenges, and strategic financial management. For those tracking “when does nano-x imaging ltd report earning,” the dates of August 12, 2025 (Q2 2025) and May 22, 2025 (Q1 2025) have provided crucial checkpoints. The next estimated earnings date is Thursday, November 20, 2025, for Q3 2025. As Tophinhanhdep.com helps visualize, navigating the complexities of NNOX’s stock requires a keen eye for detail, an understanding of both the images of success and the shadows of financial hurdles, and a long-term perspective on its disruptive potential in healthcare.